To download GSTR-1 JSON file for quarterly filing, please follow the steps below:

Step 1: Go to “Reports”.

Step 2: Click on “Taxes” and Click on “GSTR-1”.

Next, click on Download JSON.

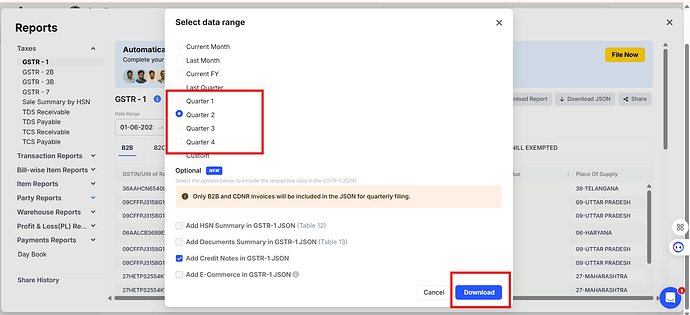

Step 3: Select the “Quarter” and click on “Download”.

Please Note:

1. Only B2B and CDNR invoices will be included in the JSON for quarterly filing.

2. Please include B2CS transactions manually in GST portal for quarterly filling.

3. Currently, we do not have option to include HSN summary in GSTR-1 JSON for quarterly so that can be entered manually.

4. You can refer to Sales Summary by HSN or GSTR-1 Excel to get HSN summary details.

- Please refer to below mentioned article to download the Hsn summary: