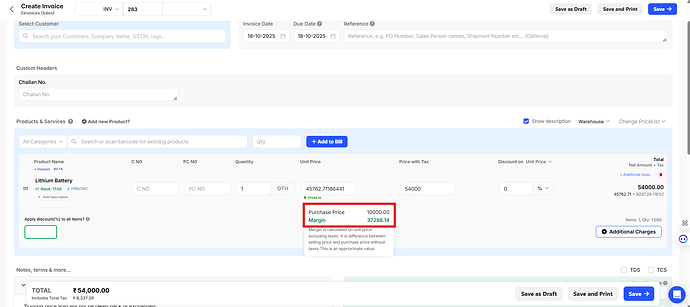

Margin is calculated on unit price excluding taxes. It is difference between selling price and purchase price without taxes.This is an approximate value.

Example:

| Particulars | Amount (₹) | Explanation |

|---|---|---|

| Purchase Price (incl. 18% tax) | 10,000 | Vendor charged including GST |

| Purchase Price (excl. tax) | 8,474.58 | 10,000 ÷ 1.18 |

| Selling Price (incl. 18% tax) | 54,000 | Charged including GST |

| Selling Price (excl. tax) | 45,762.71 | 54,000 ÷ 1.18 |

| Margin | 37,288.14 | 45,762.71 – 8,474.58 |

Overview: