To remove GST from existing sales invoice, please follow the steps below:

Step 1: Go the “Bills” and select the “Invoice”.

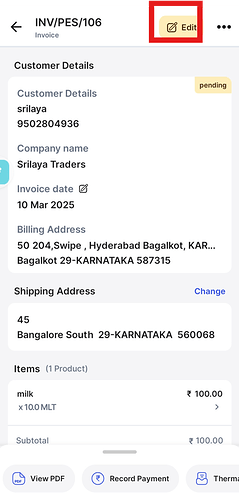

Step 2: Click on "Edit ".

Step 3: Click on “Document Edit”.

Step 4: Select “Bill of Supply” and click on “Save and Update”.

Step 5: Click on “Update”.

Please Note:

The bills of supply invoices will be displayed in GSTR1 report with 0% tax rate.

A Bill of Supply is an invoice that a seller provides for tax-exempt goods during transactions. This document is used by businesses that are not required to pay GST or those that operate under the composition scheme.